If You Build It, Will They Come? Engaging the Digital Health User is Not a Guarantee

With a price tag of $59.3 billion dollars invested since 2020, it is safe to say that healthcare’s big bet of the past three years is digital health. The excitement of meeting critical healthcare needs and the hard work of raising capital to fund these ideas keeps entrepreneurs very busy. But what about the end-users?

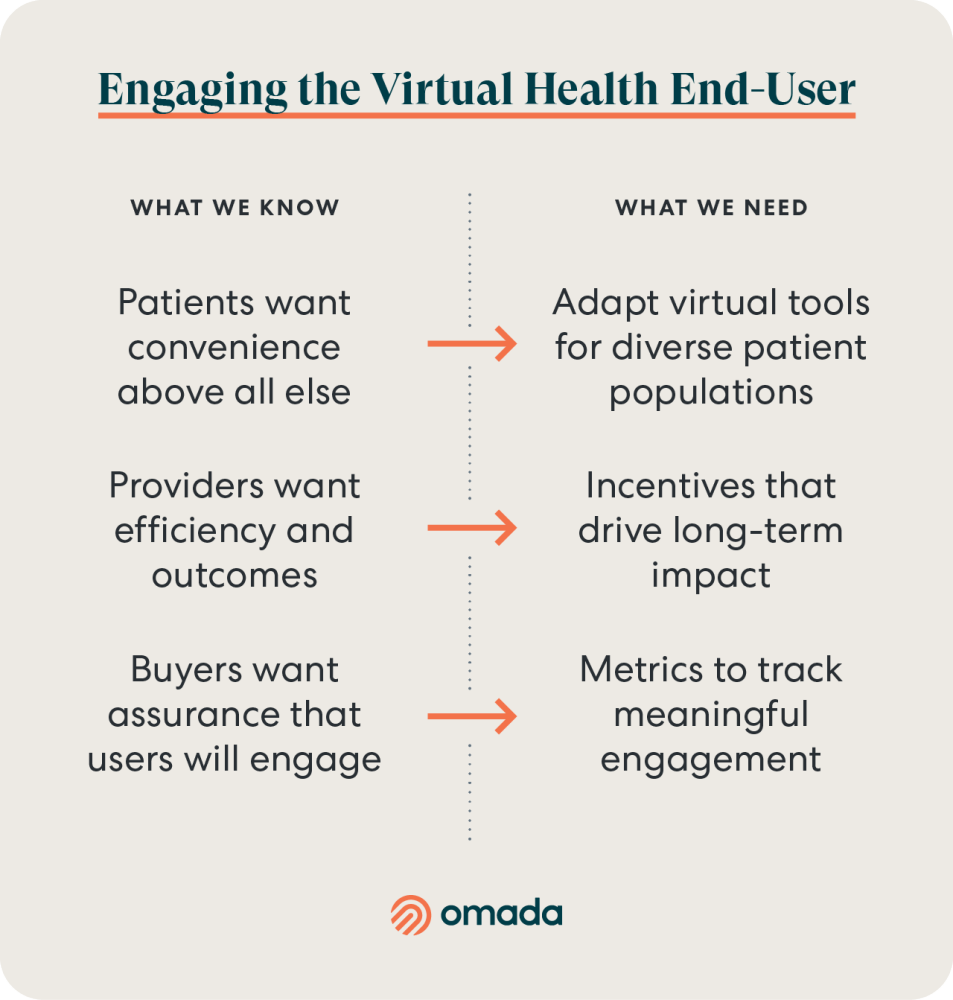

Planning for user engagement may not be top-of-mind during the early days of building a business; the focus is on building the technology and securing buyers. The confidence that a great app or service will draw in providers and patients often oversteps the reality of what users want and need. It’s time to take a pause and look at what we know about engaging both patients and providers, and what we need to learn going ahead.

What we know

Buyers want assurance that users will engage

Employer benefits leaders have deep experience with implementing solutions in the wellness space. The Kaiser Family Foundation reports that 83% of large firms offer health and wellness promotion programs, many of which have app-based components. However, employee wellness programs have a mixed reputation when it comes to savings and employee engagement. And now with 96% of large employers providing telemedicine (i.e. remote delivery of healthcare services by a physician), they have high expectations for user engagement. Implementing these programs comes with administrative overhead and expectations of employee satisfaction and health outcomes.

A recent survey by Omada Health and the Digital Medicine Society (DiMe) found that employers struggle with digital tools that promise engagement and fail to deliver results.

Patients want convenience above all else

When choosing a healthcare provider, patients typically focus on the practical pieces first. A 2022 survey by Kyruus showed that the top drivers for consumers when choosing healthcare providers are: cost (accepted insurance), convenience in booking and overall reputation of the provider. When asked about digital tools such as online scheduling and virtual visits, they were at the bottom of the list after the more practical pieces. This indicates that what consumers want from healthcare more than anything is a better (and more convenient) customer experience. This should be the primary consideration as we think about new digital tools.

Digital health companies should be focusing on solutions that improve access to care and lower costs for patients. And though the COVID-19 pandemic accelerated the adoption of digital tools to unprecedented levels, our affinity for completely socially-distanced healthcare started to decrease as we adapted to the new normal. When clinics re-opened, satisfaction with telemedicine fell from 53% to 43%, according to Rock Health. The same survey in 2021 showed that consumers preferred in-person care for well visits and mental health, and telemedicine for urgent issues and prescription refills — a convenience-based combination.

Based on this information, it is clear that for accessing medical care via virtual means, the consumer is mostly looking for quick access to their current provider who they can also see in person when it makes sense. It’s not clear whether adjunctive apps and virtual solutions that are not embedded within existing healthcare will be as attractive to patients. This is why Omada Health is partnering with health systems like Intermountain Healthcare, to give the consumer the best of both worlds: the in-person provider they want and the digital tools they need.

Provider adoption is linked to efficiency and outcomes

Another crucial user of digital health are the providers. During the pandemic, telemedicine adoption went from 14% in 2016 to 80% in 2022 among providers, according to the American Medical Association (AMA) digital health survey. The same survey revealed that in general, providers have a positive attitude about digital health, but they are also burned out from current EHR technology that does not meet their needs.

Providers want technology that integrates with current workflows and is convenient and efficient for them to use.

In addition, they are not confident that the outcomes and savings have been proven in newer technology.

Providers can be great partners for engaging consumers in digital tools by recommending these tools and integrating them into their workflows. The AMA survey also showed that plans for use of digital therapeutics are high, but current adoption is low. Reimbursement was identified as a major barrier. Without widespread reimbursement for digital health solutions - in particular Medicare and Medicaid - providers are not adopting digital health tools at high rates. For the most part, providers are still looking to their current EHR vendor for telehealth and remote monitoring tools vs. embracing newer solutions.

What we need

Incentives that Drive Long-Term Impact

Many digital health companies look to monetary incentives through gift cards or points systems via benefits platforms. These incentives are leveraged to encourage adoption and also reward program engagement over time. Research is very mixed on the impact of cash incentives on health program engagement.

One review that looked at monetary incentives for digital mental health participation had mixed conclusions, whereas another study in an obese population showed more weight loss in incentivized groups. A large-scale study of wellness program engagement clearly showed that incentives did not achieve any difference in program engagement. And another study in medication adherence showed that incentives produced higher impact at program start (<2 weeks) that was not sustained to 8 weeks. The authors concluded that extrinsic rewards like cash could be helpful for program enrollment, but not sustained engagement or behavior change. At Omada we recommend nurturing intrinsic motivation as the foundational approach to sustained engagement; however, we have experimented with extrinsic rewards throughout our ~11-year history.

Metrics to track meaningful engagement

Though it is clear that buyers want to see high adoption and sustained engagement, it is not entirely clear how they want to see that measured, or what measurement method best predicts clinical outcomes. Companies can drive short-term adoption of digital tools with marketing techniques such as gift cards and free equipment, but what buyers really want is long-term engagement that is associated with cost savings and outcomes. In short, they want it all.

Unfortunately, most traditional user engagement metrics for technology are not that useful for healthcare.

Though measures like net promoter score (NPS) and Monthly Active Users (MAU) will indicate user volume, open rates, and satisfaction, they do not accomplish the crucial join of engagement and outcomes. And that’s what buyers want—engagement that is correlated with outcomes. Therefore, measures like NPS are of limited value in healthcare. We need more research to develop metrics that make sense for digital health. From the beginning, Omada has embraced a pricing system that is linked to engagement and outcomes.

Adapt digital tools for diverse patient populations

While Pew Research shows that 85% of Americans have smartphones, digital health tools aren’t financially accessible and culturally engaging to all populations. The 2021 Rock Health survey reported that older respondents, and those with lower income and education levels use telemedicine at lower rates.

Low-income and rural populations struggle with broadband access. Health literacy and knowledge for how to access digital tools is a challenge for non-English speaking people, and those with more limited education. As we make headway on broadband access through government programs and other means, we are left with a knowledge gap on how to design digital health solutions to meet the needs of diverse populations. Though recommendations exist for technology that is multilingual and able to accommodate varying educational levels, these requirements are not feasible for early stage companies with aggressive timelines and modest engineering resources.

Conclusions

Two years after the rapid increase in funding, digital health companies are now hitting the market with their initial product releases. Many of these solutions are banking on the clinical value proposition of better health and cost savings to attract the healthcare consumer.

But without a careful eye toward provider and consumer behavior, and without clear guidance on measurement, incentives, and equity, user adoption and engagement will lag far behind expectations. What looks good on a whiteboard may not be enough to attract an increasingly overwhelmed patient and provider population.

Sources

https://www.c4dhi.org/projects/prediction-prevention-non-adherence/

https://www.psychiatrictimes.com/view/barriers-to-digital-therapeutics-adoption

https://healthcare.rti.org/insights/solving-barriers-digital-connected-care

https://www.jdpower.com/business/press-releases/2022-us-telehealth-satisfaction-study

https://www.prnewswire.com/news-releases/survey-consumers-prefer-telehealth-over-in-office-visits-for-routine-care--and-want-virtualists-to-have-access-to-their-medical-records-301664042.html

https://www2.deloitte.com/content/dam/insights/us/articles/4631_Virtual-consumer-survey/DI_Virtual-consumer-survey.pdf

https://www.elevancehealth.com/research/physical-health/what-consumers-want-from-virtual-primary-care-findings

https://business.amwell.com/press-release/new-amwell-research-finds-telehealth-use-will-accelerate-post-pandemic/

https://www.mckinsey.com/industries/healthcare/our-insights/patients-love-telehealth-physicians-are-not-so-sure

https://www.oliverwyman.com/our-expertise/insights/2022/jan/health-innovation-journal/consumer-healthcare-survey-2021.html

https://rockhealth.com/insights/consumer-adoption-of-telemedicine-in-2021/

This Proof Points edition was originally published on LinkedIn on 2/14/23.